unrealized capital gains tax meaning

It is the theoretical profit existent on paper. Generally unrealized gainslosses do not.

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

In the stock trading world a realized gain or loss is the actual gainloss that occurs as a result of closing a position.

. Related to Unrealized Capital Gain. If the proposal were to pass billionaires. Planning the tax consequences of unrealized gains and losses that are yet to be realized can help you have an overall lower tax bill.

So you realized a 10 gain. Heres a closer look inside the proposed unrealized gains tax and how it could change the concept of how we perceive capital gains and losses if it passes. As a result there is the possibility that the paper gain might be erased if the price goes back down.

They are realized gains from within a mutual fund or company in which you have invested. A gain on an investment that has not yet been realized. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum.

A tax on an increase in unrealized capital gains is only on the most stretched of interpretations a tax on income. In the second example those are unrealized gains because while youre currently up 10 over your investment if the. While the consequences of gains mean more money to invest and losses are losses understanding when to realize your capital gains and losses can give you a better idea of how to plan out for the future.

There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings. The new proposal would tax unrealized capital gains meaning that the wealthy would no longer be able to defer tax payments on gains made each year. Long-term capital gains tax rates are based on marital status and income level but they are generally lower than ordinary income tax rates and fall into only three brackets.

Such a tax is really a tax on wealth. Unrealized gains and losses aka paper gainslosses are the amount you are either up or down on the securities youve purchased but not yet sold. Tax capital gains at ordinary income rates and raise those rates to pre-Tax Cuts and Jobs Act TCJA levels.

In reality it is a tax on wealth. So a concrete example will help. The first issue is that under the existing rules capital gains are only included in income for tax purposes when an item is sold and the gains are realized which implies that the seller receives a profit because of the sale of the asset.

He bought it for 20000 from a neighbor. To increase their effective tax rate to 20 percent the household must remit an additional 12 million in tax 3 million in taxes paid with a 15 million income inclusive of unrealized gains. Kamala Harrises and AOCs of this era tuition-free college Medicare-for-all fossil-fuel elimination 70 percent tax rates racial reparations court-packing ending the Electoral College legalized infanticide but.

Its a tax thing. The Billionaire Minimum Income Tax Though named and framed as the Billionaire Minimum Income Tax the basic philosophy behind the Biden Administrations proposal is an unrealized. Farmer Bob has a small tractor.

If you still owned the house when it was valued at 350000 as opposed to selling it you would have grossed. For example perhaps you purchased a house at 300000 and sold it for 350000. David Bahnsen 05-10-2019 Source.

Because there is a shortage of tractors the market price for the. Tax pyramiding obscures the impact of taxes on taxpayers while creating situations. So even if the stock crashes or continues to rise it doesnt matter you sold your holdings and locked in a 10 gain.

409 Capital Gains and Losses Source. Taxing Unrealized Capital Gains Is a Nutty Idea. The gain is passed to you through Form 1099-DIV and it is taxable income to you.

The new proposal would tax unrealized capital gains meaning that the wealthy would no longer be able to defer tax payments on gains made each year. Answer 1 of 18. If your capital gains are the total of your gains from stock transactions plus your box 2a from 1099-DIV everything is.

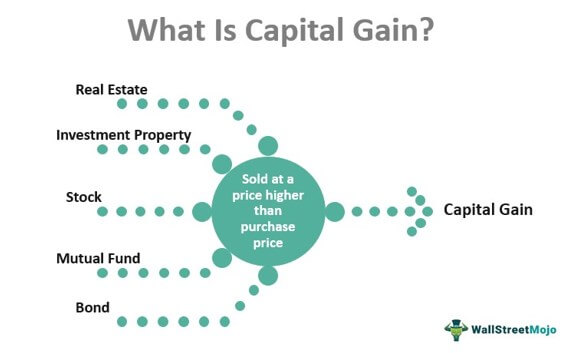

For example if you were ahead of. OkayI think before we dive into our next question we do have a couple of questions in Slido. If an investment is sold meaning that there is now a new owner of the investment the capital gain is considered to be realized Further if you realize a capital gain post-sale the proceeds are deemed taxable income.

Since unrealized capital gains are exempt from taxation a person who has an asset that appreciates. IRS Unrealized vs Realized Capital Gains. That is a paper gain occurs when the current price of a security is higher than the price the holder paid for it but the holder still owns the security.

FTTs tax financial trades placing another tax on top of existing taxes on capital gains and corporate income. Unrealized Capital Gains means with respect to a security or other asset the amount by which the fair value of such security or other asset at the end of a fiscal year as determined by the Company in accordance with GAAP and the Investment Company Act exceeds the original cost of such security or other asset as determined by the Company in. Unrealized Gain attributable to any item of Partnership property means as of any date of determination the excess if any of a the fair market value of such property as of such date as determined under Section 55d over b the Carrying Value of such property as of such date prior to any adjustment to be made pursuant to Section 55d.

He uses it on his farm. If an investor holds a stock for more than one year they pay long-term capital gains tax instead of the higher short-term capital gains tax. Unrealized capital gains put simply is the increase in the value of an asset that has yet to be sold.

Capital gains distributions are not unrealized gains. The first example is realized because you sold the stock for 1100.

The Unintended Consequences Of Taxing Unrealized Capital Gains

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

How Are Realized Profits Different From Unrealized Or So Called Paper Profits

Unrealized Capital Gains Tax What Is It Churchill

Build Back Better Legislation Tax On Unrealized Capital Gains Does Not Pass The Fairness Test Ethics Sage

How Are Futures And Options Taxed

Capital Gain Meaning Types Calculation Taxation

Strategies For Investments With Big Embedded Capital Gains

Capital Gain Formula And Taxes On Unrealized Realized Gains

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Democrats Unveil Billionaire S Tax On Unrealized Capital Gains

What Are Capital Gains Robinhood

The Preferential Tax Treatment Of Capital Gains Income Should Be Curbed Not Substantially Expanded Itep

Capital Gain Formula And Taxes On Unrealized Realized Gains

An Unrealized Capital Gains Tax Would Wallop Big Stock And Bitcoin Investors Nasdaq

The Billionaire Tax Proposal A No Good Awful Terrible Idea Youtube

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)