what is suta tax rate for california

Tax rate for new employers. Multiply the tax rate by the taxable wage base.

The new employer SUI tax rate remains at 34 for 2021.

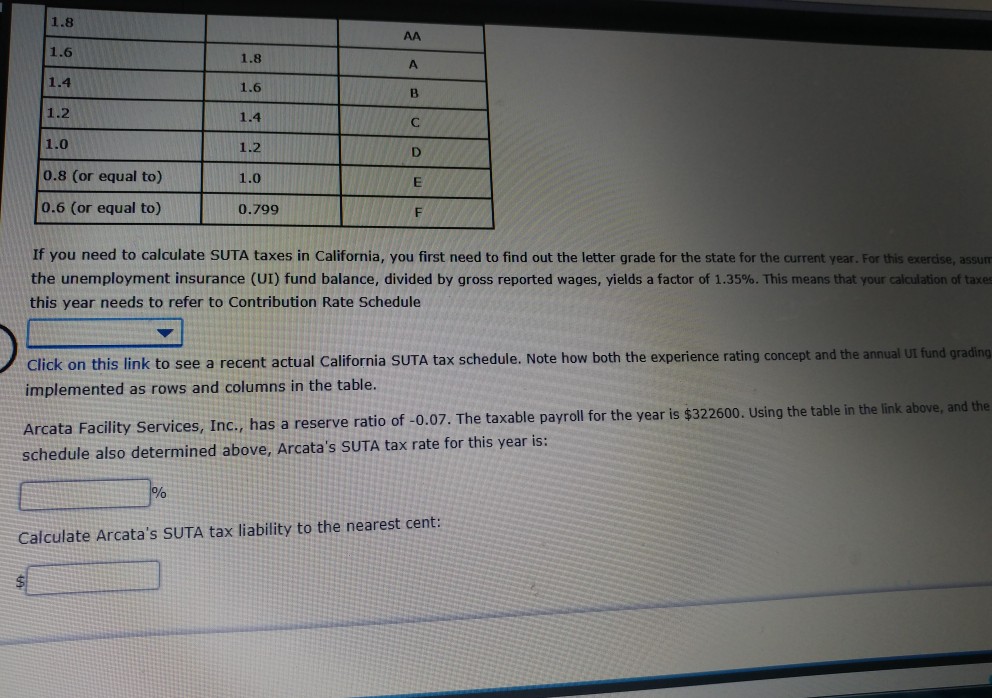

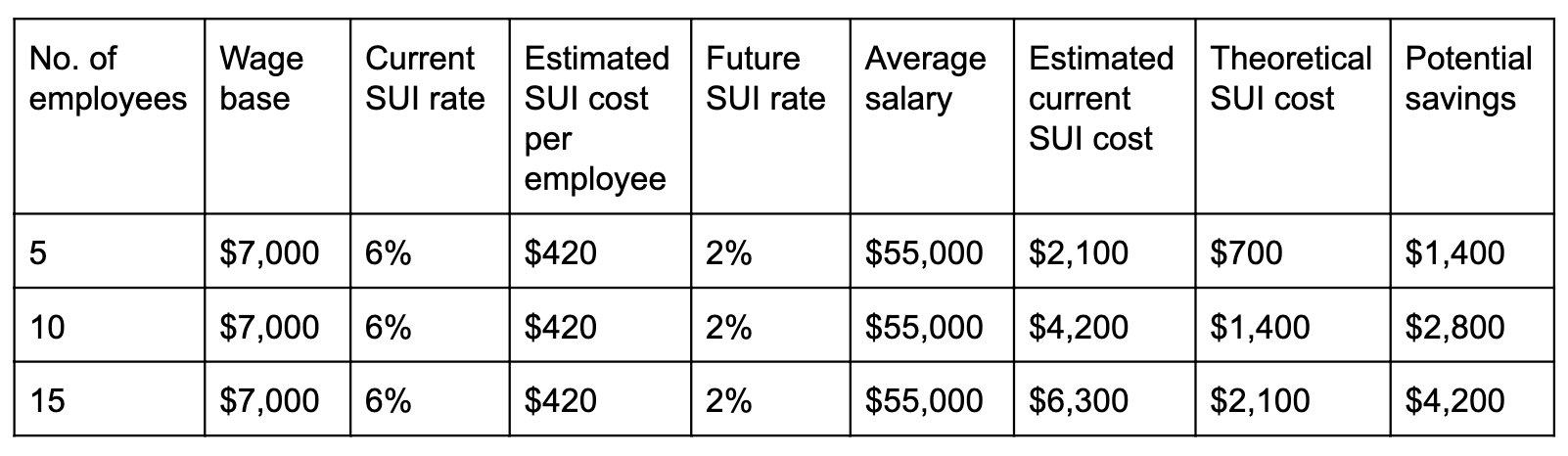

. Lets say that your tax rate the percentage you pay on the wage base limit is 5 and you have 3 employees. To calculate your SUTA tax as a new employer multiply your states new employer tax rate by the wage base. What is the SUTA tax rate for 2021.

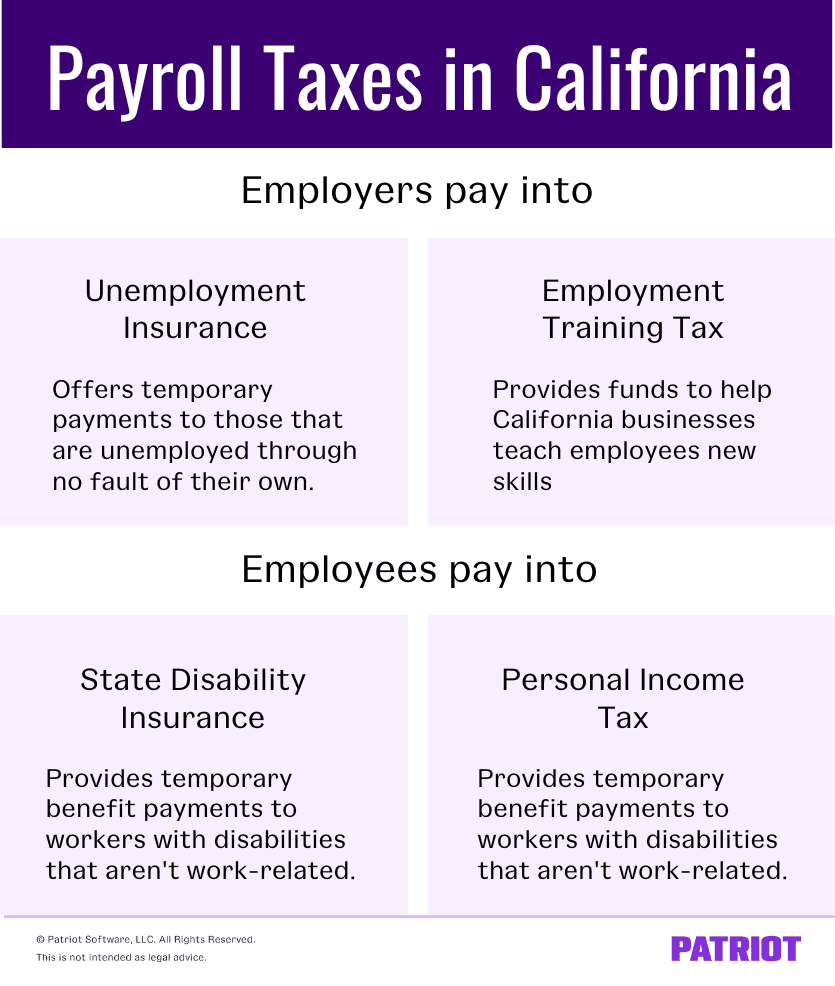

The rate is based on the balance in the SDI Fund and the amount of disbursements and wages paid. State unemployment tax assessment SUTA is based on a percentage of the taxable wages an employer pays. The new employer SUI tax rate remains at 34 for 2020.

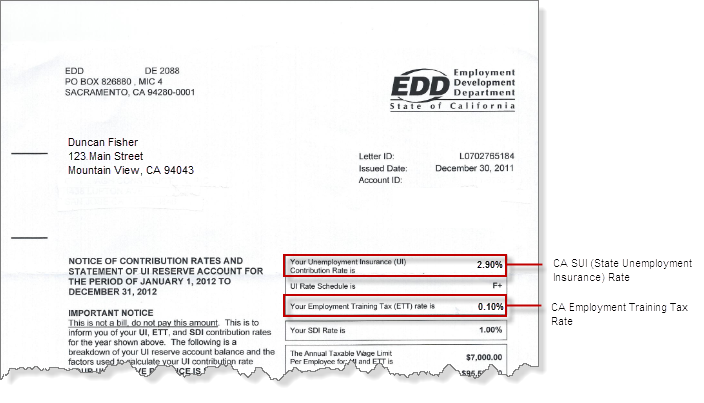

The SUI rate schedule is expected to remain F for the foreseeable future. Who is exempt from SUTA taxes. Please visit our State of Emergency Tax Relief page for additional information.

To calculate your SUTA tax as a new employer multiply your states new employer tax rate by the wage base. Here is how to do your calculation. The FUTA tax rate is a flat 6 but is reduced to just 06 if its paid on time.

5 of 7000 350 350 x 3 1050 You will pay 1050 in SUI. How do you calculate SUTA tax. CDTFA public counters are now open for scheduling of in-person video or phone appointments.

For example if you own a non-construction business in California in 2021 the SUTA new employer tax rate is 34 and the taxable wage base per worker is 7000. The withholding rate is based on the employees Form W-4 or DE 4. The new employer SUI tax rate remains at 34 for 2021.

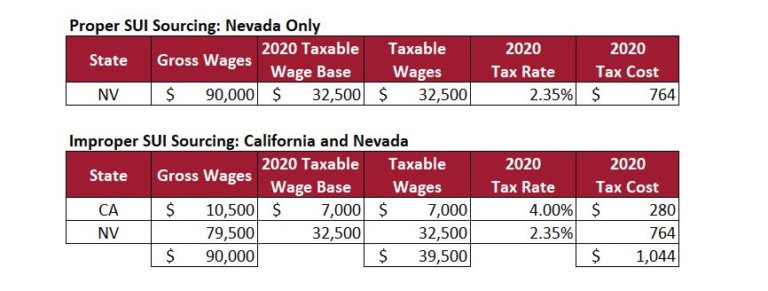

The taxable wage limit is 145600 for each employee per calendar year. The SDI withholding rate for 2022 is 110 percent. SUTA dumping is a tax evasion scheme where shell companies are set up to get low UI tax rates.

Tax rate for new employers. For questions about filing extensions tax relief. Review the PIT withholding schedule.

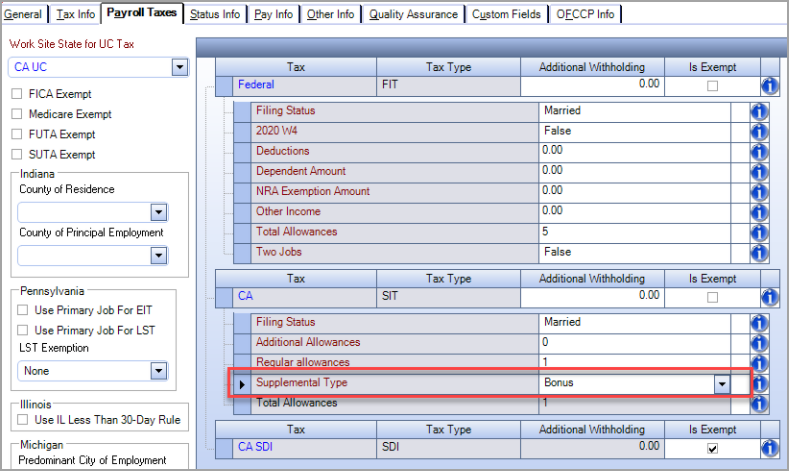

New Hampshire has raised its unemployment tax rates for the second quarter of 2020. California PIT is withheld from employees pay based on the Employees Withholding Allowance Certificate Form W-4 or DE 4 on file with their employer. The tax rate for new employers is 17.

The maximum to withhold for each employee is 160160. You cannot protest an SDI rate. What is the SUTA rate for 2021.

For more information review Tax-Rated Employers. Tax rates for the second quarter range from 01 to 17 for positive-rated employers and from 33 to 75 for negative-rated employers. Tax rate for new employers.

California does have an outstanding loan balance as of January 1 2021 so future credit reductions are. As a result of the ratio of the California UI Trust Fund and the total wages paid by all employers continuing to fall below 06 the 2021 SUI tax rates continue to. Current federal law provides employers with a 54 percent FUTA tax credit and no FUTA tax credit reduction will occur in 2022 for wages paid to their workers in 2021.

Tax rate for experienced employers. Businesses impacted by recent California fires may qualify for extensions tax relief and more. Tax rate for experienced employers.

² Experienced Nebraska and Rhode Island employers that are assessed the maximum unemployment tax rate are assigned a higher wage base. As a result of the ratio of the California UI Trust Fund and the total wages paid by all employers continuing to fall below 06 the 2021 SUI tax rates continue to include a 15 surcharge. For example if you own a non-construction business in California in 2021 the SUTA new employer tax rate is 34 and the taxable wage base per worker is 7000.

For past tax rates and taxable wage limits refer to Tax Rates Wage Limits and Value of Meals and Lodging DE 3395 PDF or Historical Information. The entity with the higher rate is then dumped SUTA dumping is also referred to as state unemployment tax avoidance and. As a result of the ratio of the California UI Trust Fund and the total wages paid by all employers continuing to fall below 06 the 2021 SUI tax rates continue to include a 15 surcharge.

Please contact the local office nearest you. There is no taxable wage limit. For example the wage base limit in California is 7000.

The EDD repaid its federal UI loan balance in 2018 prior to. However Virgin island employers must pay 24 to the government since this territory owes the US government money. The 2020 California employer SUI tax rates continue to range from 15 to 62 on Schedule F.

New Jersey Department of Labor. The FUTA and SUTA taxes are filed on Form 940 each year regardless if a business has an employee on unemployment insurance. When a low rate is obtained payroll from another entity with a high UI tax rate is shifted to the account with the lower rate.

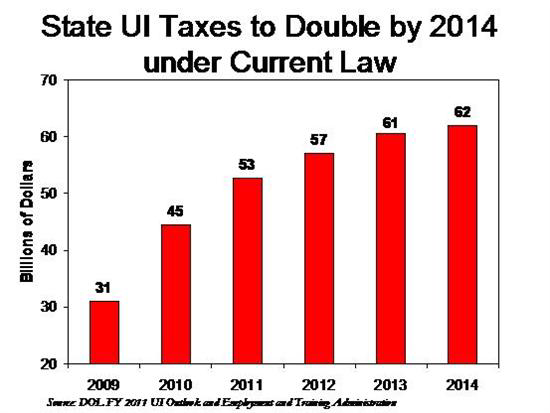

There is no maximum tax. The new employer SUI tax rate remains at 34 for 2021. May 2019 UI fund forecast Beginning on January 26 2009 California began borrowing from the federal government to pay UI benefits.

Understanding California Payroll Tax

Suta Tax Your Questions Answered Bench Accounting

Exclusively Blown For Swank Lighting By California Artist Joe Cariati These Violet Beauties Are From The Second Edition Of Jo Lamp Glass Lamp Glass Table Lamp

Calculator Percentage Equal To Or Less Than Chegg Com

Pay California Supplemental Tax Type

Updating Suta And Ett Rates For California Edd In Qbo Youtube

10 1 Unit 10 State Payroll Taxes And Reports Mcgraw Hill Irwin Copyright C 2006 The Mcgraw Hill Companies Inc All Rights Reserved Ppt Download

Free California Payroll Calculator 2022 Ca Tax Rates Onpay

Understanding California Payroll Tax

Sui Definition And How To Keep Your Sui Rate Low Bench Accounting

How To Reduce Your Clients Suta Tax Rate In 2014

What Is Sui State Unemployment Insurance Tax Ask Gusto

Payroll Taxes Cost Of Hiring An Hourly Worker In California In 2020

Is A Change In State Unemployment Reporting Necessary Due To Covid 19 Workforce Wise Blog

How To Update Suta And Ett Rates For California Edd In Quickbooks Desktop Youtube